Unbiased picks • US small businesses • 2026

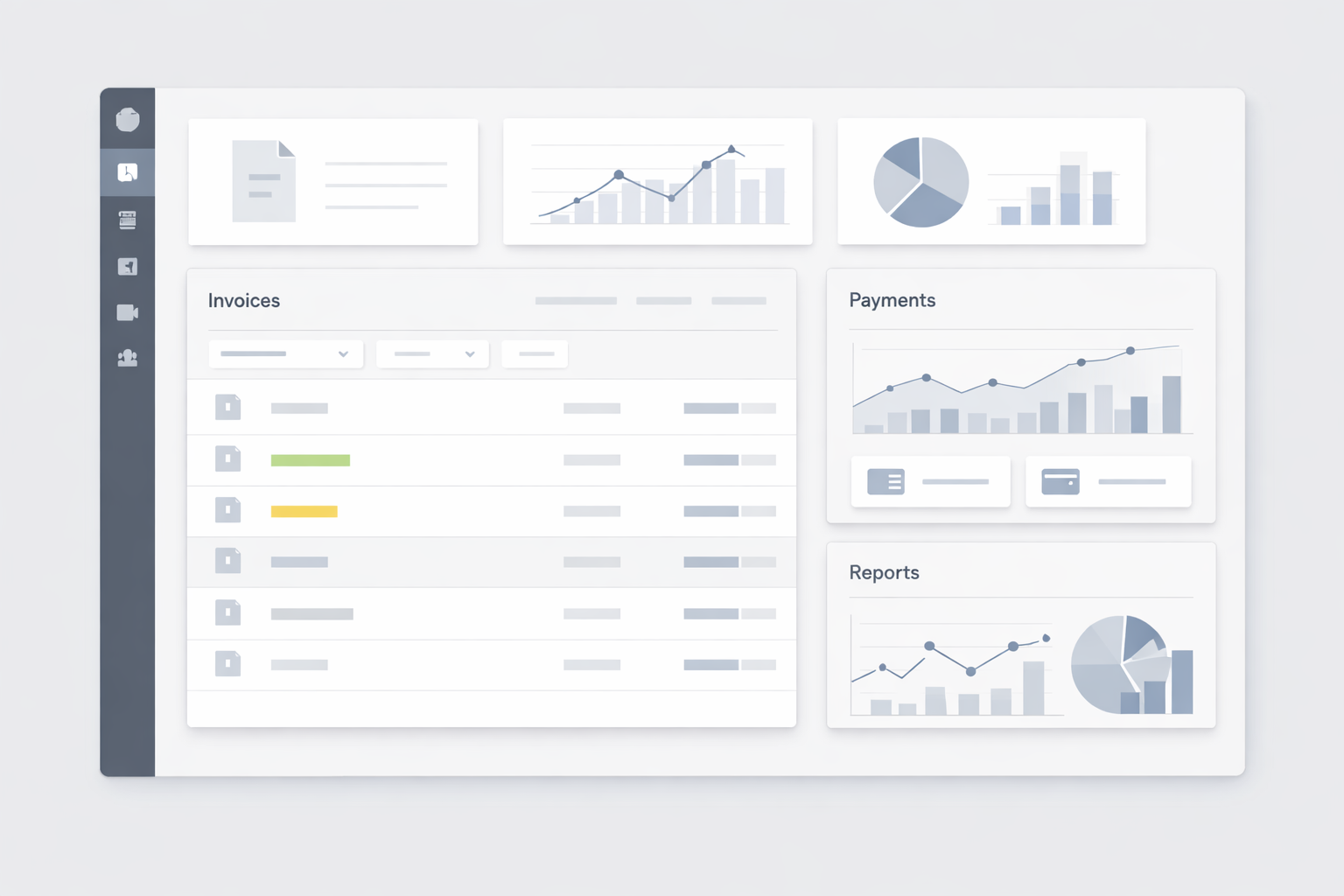

Best Invoicing Software for Small Businesses (2026)

This guide compares top invoicing tools for U.S. small businesses in 2026. A workflow-focused comparison for U.S. owners: invoice fast, get paid faster, avoid “feature checklist” traps.

Start with the comparison table below for the fastest answer.

Quick verdict: top picks (2026)

QuickBooks

Best all-around choice for most U.S. small businesses that want invoicing + accounting in one place.

FreshBooks

Fast invoicing workflow, strong client experience, great fit for service-based solo operators.

Zoho Invoice

Strong invoicing fundamentals without paying for heavy accounting you might not need.

Invoice2go

Mobile-first invoicing for field work and on-the-go sending (contractors, technicians, teams in motion).

Rankings are editorial. We do not accept paid placements.

For most U.S. small businesses, QuickBooks is the safest all-around choice.

Try QuickBooksRankings are editorial. We do not accept paid placements.

Jump to a review

How we pick winners

This comparison focuses on U.S. small-business invoicing workflows: payment links, client experience, automation, and day-to-day use. In practice, invoicing is the core of most small-business billing workflows — send, collect, remind, and track what’s outstanding.

We prioritize time-to-invoice, getting paid fast, automation, reporting basics, and long-term fit (not just feature checklists) when ranking the best invoicing software for small businesses.

Compare the best invoicing software (2026)

Use this table to compare pricing, best use cases, and standout strengths at a glance.

| Software | Best for | Price (from) |

Standout strengths | Score | |

|---|---|---|---|---|---|

|

QuickBooks Read full review → |

Most small businesses | From $38 |

• Invoicing + accounting • Reporting • Strong ecosystem |

9.3 | Check pricing |

|

FreshBooks Read full review → |

Freelancers & service businesses | From $8.40 |

• Fast invoicing • Time tracking • Client-friendly payments |

9.1 | Check pricing |

|

Zoho Invoice Read full review → |

Budget-focused teams | Free ($0) |

• Core invoicing • Templates • Lightweight automation |

8.9 | Use free |

|

Invoice2go Read full review → |

Mobile / field work | From $5.99 |

• Mobile-first • Estimates → invoices • Fast send |

8.7 | Check pricing |

|

Wave Read full review → |

Very small businesses | Free ($0) |

• Simple invoicing • Low overhead • Quick setup |

8.5 | Use free |

Prices shown are starting monthly rates (USD). Actual pricing may vary by plan, billing cycle, promotions, and region.

👉 Want the fastest path to getting paid? QuickBooks is our top pick for most small businesses in 2026.

Our top pick (deep dive): QuickBooks

QuickBooks is our top pick for most U.S. small businesses because it combines invoicing with accounting, has strong reporting, and fits the most common owner/operator workflows.

- Reliable all-around workflow (invoicing now, accounting later)

- Strong reporting for owners

- Commonly adopted across U.S. small businesses

- Can feel heavy if you only send a few invoices/month

- Cost can rise as you add features/users

- Owners who want a long-term “no regrets” choice

- Businesses that will eventually need accounting

- Teams that value reporting and ecosystem integrations

- Very low-volume invoicing (a few invoices/month)

- Those who want invoicing-only at the lowest possible cost

- Simple workflows where accounting is not needed

Want the simplest decision?

We don’t accept paid placements for rankings.

Short reviews (money-focused)

Below are short, workflow-focused notes based on common U.S. invoicing and getting-paid scenarios.

QuickBooks — Best for most small businesses

Best if you want invoicing plus accounting in one place, with strong reporting and a mature U.S. ecosystem.

- All-in-one invoicing + accounting workflow

- Strong reporting for owners

- Scales well as you grow

- Can feel heavy if you only send a few invoices/month

- Pricing increases as needs grow

FreshBooks — Best for freelancers

Best if you’re service-based and want fast invoicing, a clean client experience, and a workflow that stays lightweight.

- Very clean invoicing flow

- Strong client payment experience

- Great for service & solo operators

- Less ideal if you want deep accounting features

- Some workflows require upgrades

Zoho Invoice — Best budget pick

Best if you want strong invoicing fundamentals without paying for heavy accounting features you won’t use.

- Strong core invoicing features

- Good value for cost-sensitive businesses

- Solid templates & basic automation

- May require add-ons / other tools depending on your stack

- UI preferences vary

Invoice2go — Best mobile invoicing

Best if you send invoices from job sites and want a mobile-first workflow built for speed.

- Mobile-first, fast send

- Great for field work (estimates → invoices)

- Quick client turnaround

- May feel limited for deep office accounting workflows

- Pricing may be less attractive at scale

Wave — Best for very small businesses

Best if you invoice occasionally and want a simple setup with minimal overhead.

- Simple invoicing experience

- Good for low-volume invoicing

- Quick to start

- May not scale well for complex workflows

- Advanced features can require paid add-ons

What to look for (U.S. small businesses)

- Time-to-invoice: create and send in under 2 minutes.

- Get paid: payment links, fee clarity, payout speed.

- Automation: reminders, recurring invoices, late-fee options.

- Client experience: clean invoice, easy payment flow.

- Reporting: outstanding invoices, basic cashflow visibility.

- Long-term fit: will it still work when you grow?

How we evaluate invoicing software

To rank the best invoicing software for small businesses, we evaluate each tool using real U.S. workflows, focusing on speed, payments, automation, and long-term usability. We treat invoicing tools as billing systems: sending invoices is step one, getting paid is the real job.

- Time-to-invoice: create and send in under ~2 minutes

- Get paid: payment links, fees clarity, payout options

- Automation: reminders, recurring invoices, basic workflows

- Client experience: clean invoice + easy payment flow

- Owner visibility: outstanding invoices + basic reporting

- Long-term fit: still usable when the business grows

- We compare tools on real small-business workflows (not feature checklists).

- We review pricing changes and plan limits periodically.

- We prioritize tools that reduce time spent invoicing and speed up getting paid.

Want to understand how we score tools? Read our editorial methodology →

Quick summary: best tools by business type (2026)

This guide reviews the best invoicing software for small businesses based on real U.S. workflows, pricing transparency, and how quickly business owners can send invoices and get paid.

Who this guide is for (and not for)

- Freelancers and solo operators

- Service businesses (consultants, agencies, contractors)

- Small teams that need simple invoicing + basic reporting

- U.S. businesses that want faster billing and faster payments

- Large enterprises with ERP-level finance needs

- Complex multi-entity accounting requirements

- Teams needing advanced procurement or custom billing engines

FAQ

How do I choose the best invoicing software for small businesses?

Start with your workflow (solo vs team), how you get paid, and whether you need accounting now or later.

What is the best invoicing software for a small business in 2026?

For most U.S. small businesses, QuickBooks is the safest all-around choice due to long-term fit and reporting.

Do I need invoicing software if I only send a few invoices per month?

Not always. If simplicity and cost are your priority, Wave or Zoho Invoice can be enough.

What’s the difference between billing and invoicing?

Invoicing is creating and sending invoices. Billing is the full process: invoices + payment collection, reminders, and tracking what’s outstanding.

What’s the difference between invoicing software and accounting software?

Invoicing focuses on billing and getting paid. Accounting adds bookkeeping, reconciliation, and financial statements.

Which tool is best if I work from my phone?

If your workflow is on the go, Invoice2go is built for mobile speed.

For accounting standards and small-business guidance, we reference publicly available resources such as the U.S. Small Business Administration.

Bottom line

This guide focuses on identifying the best invoicing software for small businesses based on real U.S. workflows, pricing transparency, and how quickly owners can send invoices and get paid.

Safest “no regrets” choice: QuickBooks.

Freelancer-friendly: FreshBooks.

Lower overhead: Zoho Invoice or Wave.

Mobile-first speed: Invoice2go.

If you want the safest long-term pick, QuickBooks remains our top recommendation for most U.S. small businesses in 2026.

Rankings are editorial. We do not accept paid placements.